Content

You’re able to get some tax rescue in the event the stock away from a friends you own goes broke…. Old-fashioned knowledge states teenagers find the money for getting aggressive having their investment, however, keep in mind you can find items when that may maybe not apply. Find out about the fresh criteria we used to evaluate position game, with sets from RTPs so you can jackpots.

- In addition to, as the Passive position is very easily available due to programs, people is also pop in and you can play when he’s got particular spare time – no need to loose time waiting for a timeless on-line casino to start up the gates.

- Canadian Couch potato emphasizes the significance of staying with an initial money bundle over the long-term.

- We assume both has a portfolio from Canadian equities appreciated from the 250,100 at the beginning of 2014.

- Within this graph, i’ve a go through the complex collection models during the three risk profile.

Beam Dalio The Climate Collection Opinion, ETFs, & Leverage (

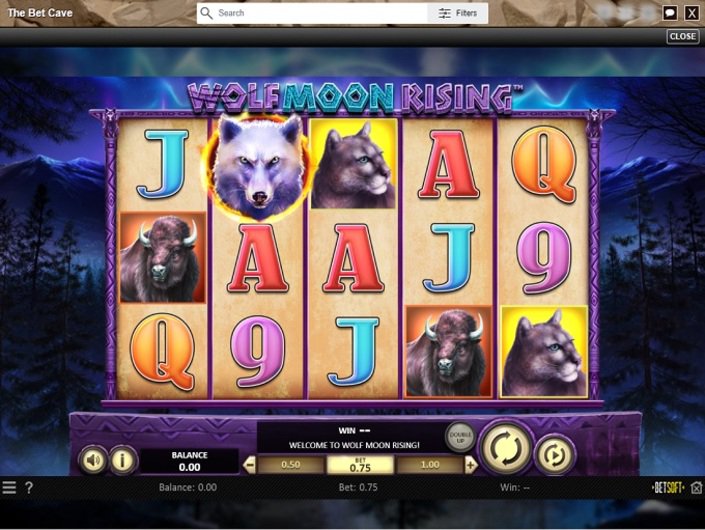

For those who bet about three https://happy-gambler.com/sticky-bandits/rtp/ or higher coins, the ability to obtain the jackpot expands. The online game cannot replacement cherries if they’re also by yourself for the a line, but landing several wilds increases the payment. The newest format is greatly lent of genuine local casino slots, and therefore of many participants delight in. For the enjoy dining table on the screen’s side, what you may seem messy, nevertheless attention stays on the reels.

Invest or pay back financial obligation: An extensive publication to have Canadians

But neither if they resign on their own so you can using charge better north out of dospercent. For many who’ve started a reader for some time, you are aware which i provides an extended organization having MoneySense, a newspaper I led to for most 15 years while the a feature writer, columnist, and you can editor. MoneySense didn’t create your butt Potato means, nevertheless journal brought the theory to Canada around the change of your own millennium, whenever index fund was uncommon and you will ETFs were nearly totally unfamiliar on the social. All of the gambler who’s impression annoyed and you may doesn’t know very well what doing can get have fun with the Couch potato freeslot getting more a real income if you are passing the time in the an excellent pleasant and you may safe method. There is no need to go anyplace as your favourite video game that have a really brilliant structure and unbelievable graphics is obviously at the hand. Here’s the fresh near-name evaluation of balanced collection models, key rather than cutting-edge.

Your don’t need to use replace-exchanged fund (ETFs) to hang a couch potato profile, but ETFs are the most famous approach to doing a great sensible, low-percentage, worldwide diversified profile. You’ll as well as find couch potato rules, in addition to backlinks to your inactive portfolio habits. Let’s evaluate the new core inactive portfolios to the advanced settee potato designs. But perform the holdings in these money do along with definitely handled finance? Section of my personal character would be to evaluate Orange clients’ mutual finance held during the other banks and you will common fund people to the brand new Orange directory-based common finance profiles (they didn’t yet , provide the ETF portfolios at the time). It was most uncommon to get increased-commission mutual fund combine you to definitely overcome the brand new Orange approach across the long-term.

- If, however, you have money you believe you’ll you would like usage of in this 2 yrs or smaller, it could be smart to adhere risk-free alternatives, such as highest interest offers accounts and you may GICs.

- This method is fantastic people just who favor a give-of method of spending and would like to prevent the fees and you can complexity of actively handled financing.

- The phrase is ever more popular in recent times as the the community grows more inactive.

- Due to the large volatility, payouts require some persistence, but when they happens they are very large.

- For more information on performing by far the most taxation-efficient ETF Passive portfolio, read this article.

The new Vanguard The-Equity ETF Portfolio (VEQT) makes you do so that have an individual financing. It ETF is approximately 40percent United states equities, 30percent Canadian equities and you may 29percent worldwide equities, covering each other create and you may emerging places. They retains nearly 14,100 holds worldwide, plus it becomes immediately rebalanced, so it requires simply no fix—all of the to possess an annual administration expenses ratio (MER) fee of only 0.24percent. Ties usually increase inside value whenever inventory areas bring a critical strike, so they manage the stock market risk (2022 has been an exemption). When you’re here’s no make certain for the inverse matchmaking, it’s essentially acknowledged one holding carries and you may securities together with her creates a good lower-exposure profile. Before you can be an inactive individual, you must influence an educated advantage allowance (percentage of stocks, ties, an such like.) for the collection considering the risk tolerance and go out views.

Ideas on how to Get Canadian Passive’s Doing it yourself ETF Profiles

I’ve been discovering regarding the Canadian Inactive funding approach and you may have some concerns. The ETF using approach feels like it may be an excellent fit for my RRSPs. As i look at the model collection to possess ETFs, he’s got simply step three ETFs within their profile (ZAG, VCN, and you will XAW) plus the ratio of every ETF changes considering your own exposure peak. Individual step one receives an excellent twenty-five,000 windfall and you may requires the newest mentor to include it to help you his profile.

M1 Money The newest Bonus Reinvestment Features Is actually Right here! (Sneak Peek)

And you also continue to have more property — 535,163 — than simply after you first started. For individuals who started three decades ago, you’d the advantage of the newest bull field of your own ‘1990s. While the value of the portfolio denied inside three from the initial 10 years, the newest hurry of your own late ‘1990s carried your as a result of about three successive numerous years of the newest dotcom freeze because the the fresh 100 years first started. A collection from merely gas and oil businesses is probably shorter varied than a portfolio one to spends around the several sectors and you may places. The number of ETFs to include in your portfolio relies on what number of underlying holdings that the ETF provides.

It is very important from time to time comment and you may rebalance the fresh portfolio to retain the wished investment allotment. You have got a collection out of 100percent equities, and you are along with settling debt. The borrowed funds prepayments are a sound choice, nonetheless they’lso are not merely a different way of to shop for fixed income. Very just make sure you are comfortable with the possibility of a a hundredpercent equity profile. Justin analyzed the fresh Long lasting Profile having fun with Canadian analysis to possess T-expenses (cash), silver and enough time-term ties. On the inventory allotment the guy used a level split of Canadian holds and also the MSCI Industry Index.